Table of Content

You can check your credit score for free on WalletHub. You should also check your credit report for errors. As long as you have at least a 600 credit score, you should be able to qualify for an unsecured personal loan and wont have to put down collateral.Compare terms. You can use WalletHubs personal loan comparison tool to narrow down your options by credit score required, loan amount, your location and more.

401 loan lets you borrow money from your retirement account. You will need to repay the loan, along with interest, within 5 years of taking it out, or else there are taxes and penalties, in most cases. If you can beat smoking this year, you may qualify for lower premiums next year. Opening a flexible spending account, or FSA, gives you the opportunity to pay for medical, dependent care or. A home equity loan is a form of credit where your home is used as collateral to borrow money. It’s typically used to pay for major expenses .

Credit Education

Fixed-rate loans have a stable interest rate over the life of the loan. An adjustable-rate mortgage has a fixed interest rate for a few years before the rate floats with the market. There are 2 ways to start the application for the USAA VA Home Loan, and chances are you are already logged into your online account. If you’re not logged in yet, click here to get started with finding the purchase rate and different options available to you. If you’re a Guardsman or Reservist and have ever been activated to deployment in a war zone, you’d be able to apply under the active-duty rate. It was early July, and then I tried for the World MC they did lock me out, but I spoke to the CC rep and he said that there would be no issues...

The reviewed auto lenders all share a commitment to work with consumers of every credit type, including those with bad credit or no credit at all. Once youve joined USAA, you can begin the process of applying for an auto loan. You can apply for a new auto loan, used auto loan or USAA auto refinance loan online by logging into your USAA account.

Does USAA do a hard inquiry?

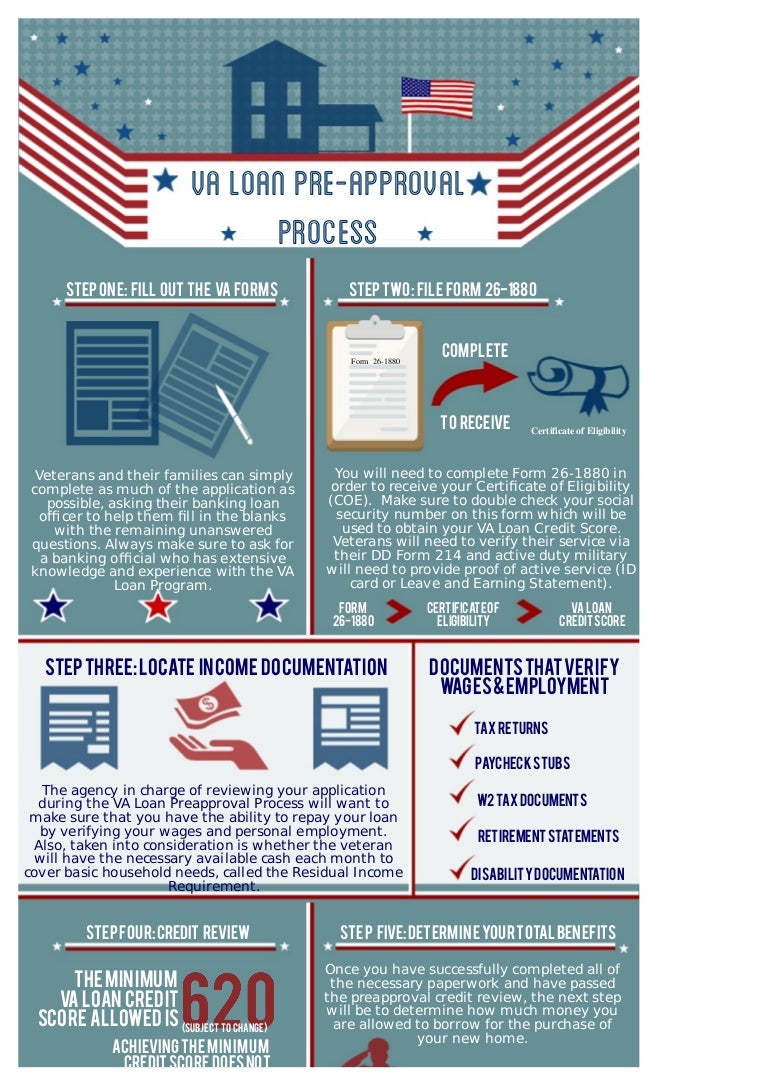

Hardship or disaster loans, whether it’s to help pay rent or to keep a small business afloat. These loans typically have eligibility requirements that are different from state to state. No. 5 in Customer Ratings for VA purchase lenders, Current The VA Loan Pre-Approval Process.

This guarantee protects these lenders from default. That is, if a veteran stops paying back his or her VA loan, the government will reimburse a portion of the outstanding loan balance to the lender. While the Department of Veterans Affairs oversees the VA loan program, it doesn’t actually lend money. Instead, a number of VA-approved banks, credit unions, and mortgage companies originate these loans. As such, we’ll use this article to provide an overview of the USAA VA loan.

Key Terms To Know About Personal Loans

USAA doesn’t offer FHA or USDA (U.S. Department of Agriculture) loans. USAA is a diversified financial services company that offers various solutions like banking insurance, investments, and retirement. The company's focus is to provide these solutions to members of the U.S. military, veterans, and their families. It's a membership-based platform that was founded in 1922. The company had 13 million members and 35,000 employees at the end of 2019. USAA offers loans to U.S. military members, their spouses, as well as the children of USAA members.

A pawnshop will evaluate a personal item that you bring in as collateral and loan you a percentage of its value. Pawnshop loans offer instant cash but can sell your property if you fail to repay the loan. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company. That could allow you to buy a home with no money down. FHA and Conventional loans need just 3.5% or less down, but 100% of the down payment can be a gift.

Can I Refinance My Gm Financial Loan

And, this loan volume relates directly to specialization. That is, USAA only offers VA loans (fixed-rate, ARM, and jumbo), meaning its loan officers have intimate understanding of the VA loan process. However, the loans are only available to eligible military members. Only U.S. military members, veterans, their spouses, and children qualify. A mortgage pre-approval is a written statement from a lender that signifies a home-buyers qualification for a specific home loan.

Just know that interest, also called finance charges, will still accrue during this deferral period. If you want a 72-month car loan, USAA requires you to borrow at least $15,000. And for an 84-month loan, youll need to borrow at least $25,000 and buy a vehicle from the model years 2020 to 2022. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they’re available to people with bad credit. What Credit Score Needed For Home Loan What Credit Score is Needed to Buy a House?

1St Time Home Owners Loan Home values fell 1.10% nationally in May, but posted a 3.54% year-over-year increase, according to the Quicken Loans HVI. And the first improvement following six months of growing gaps between the. Maurice “Chipp” Naylon spent nine years as an infantry officer in the Marine Corps.

If youre already at the dealer, you can apply by phone via the USAA mobile app. Refinancing rates arent spelled out online youll need to play around with the USAA car loan calculator to get an idea of what rates you might qualify for. USAA does not publicly disclose many of its borrower requirements.

You may want to hire a professional before making any decision. WalletHub does not endorse any particular contributors and cannot guarantee the quality or reliability of any information posted. The helpfulness of a financial advisor's answer is not indicative of future advisor performance. You can withdraw money from your 401 because of an important, immediate financial need. However, you cannot take out more than necessary to satisfy the need and you cannot repay the withdrawal. Mounting student loan debt totals, after all.

USAA VA Loan

If it ran commercials, Capital One Auto Finance might ask, Whats in your garage? To receive pre-approval, youll have to show a monthly income of at least $1,500 to $1,800, depending on your credit history. If your service was between 1957 and 1967, you’ll need to make sure the credits are added to your record at the time you apply. Credit Score Needed First Time Home Buyer Last month, the average.

Flexible loan terms that extend up to 84 months, with no payment due for up to 60 days after your loan is approved . Payday loan is a small, short-term loan that you pay back with your next paycheck. But payday loans are incredibly expensive compared to normal personal loans, so they are not worth pursuing except as a last resort. Overall, USAA offers an outstanding VA loan product and application process. While certainly not the only VA-approved lender, USAA does stand out as one of the better ones. USAA also has a VA jumbo loan, which is for service members looking to finance more than $510,400.

No comments:

Post a Comment